Crypto Crash: Unveiling the Factors Behind $920 Billion Liquidation in 24 Hours

What Led to the $920 Billion Crypto Liquidation in Just One Day

The IT industry saw a huge sell-off in the last day, which caused the cryptocurrency market to plummet by $920 billion.

The volatility and quick changes that might take place in the world of digital currencies are highlighted by this incident.

The tech business is becoming more competitive, and U.S. tech stocks have seen significant losses as a result of the Chinese startup DeepSeek's recent release of a free, open-source AI model.

The volatility and quick changes that might take place in the world of digital currencies are highlighted by this incident.

The tech business is becoming more competitive, and U.S. tech stocks have seen significant losses as a result of the Chinese startup DeepSeek's recent release of a free, open-source AI model.

Did you know? You can comment on this post! Just scroll down

Cryptocurrencies, which frequently correspond with tech stocks, have been impacted by this.

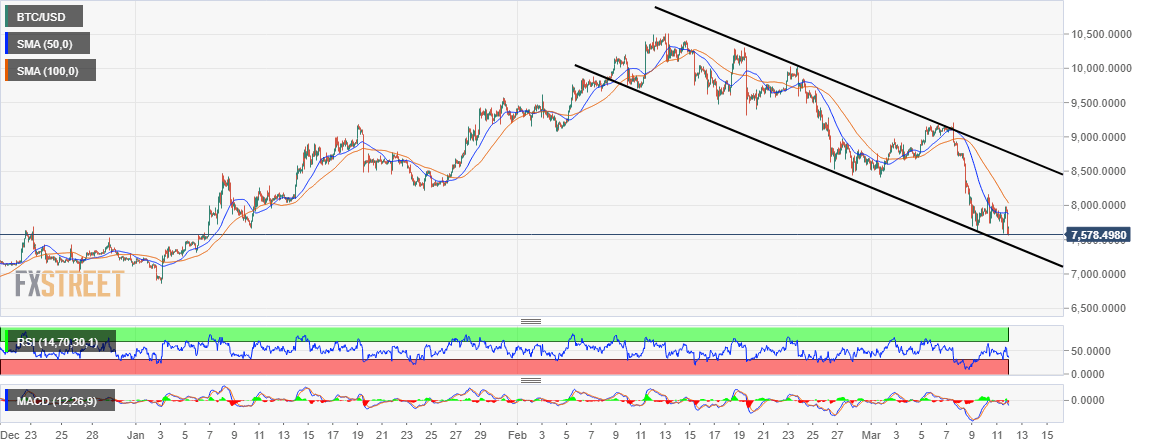

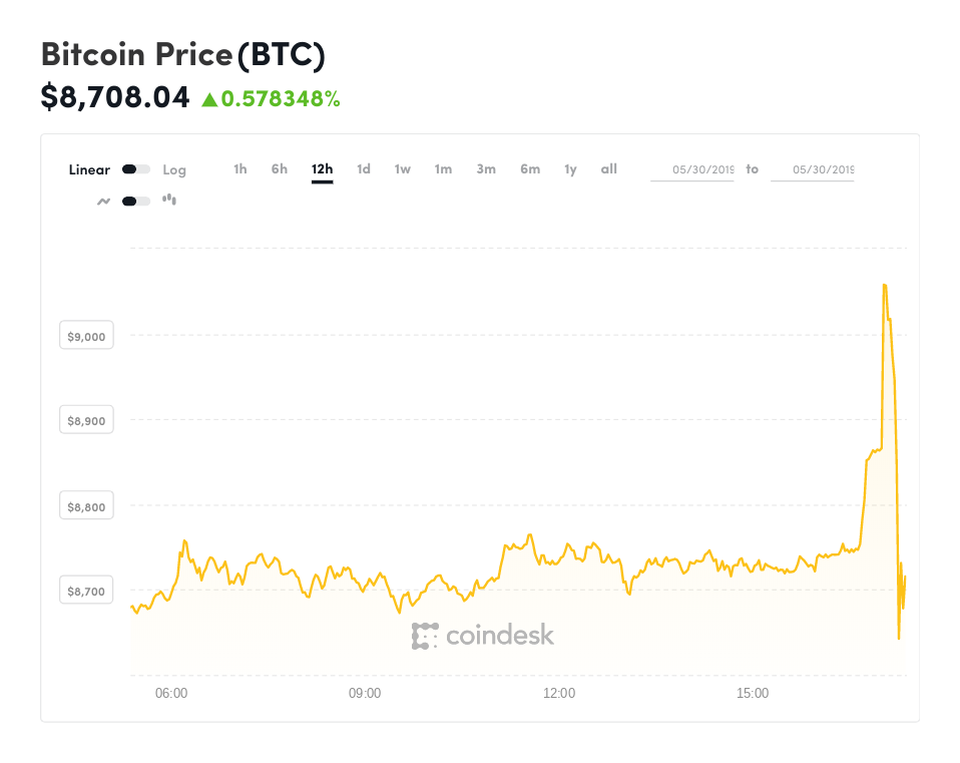

Bitcoin hits its 11th day low.

The most popular cryptocurrency, Bitcoin, dropped below $100,000 and reached an 11-day low. There were also notable drops in other well-known cryptocurrencies, like as Dogecoin, XRP, Ethereum, and Solana.

Bitcoin hits its 11th day low.

The most popular cryptocurrency, Bitcoin, dropped below $100,000 and reached an 11-day low. There were also notable drops in other well-known cryptocurrencies, like as Dogecoin, XRP, Ethereum, and Solana.

- According to analysts, this decline has been exacerbated by the close relationship between Bitcoin and tech equities, especially the Nasdaq 100.

- Expectations on U.S. Federal Reserve policy have also affected market mood. Investors expect the Fed to keep interest rates higher for a long time, which has traditionally resulted in a lower willingness to take on risk across a range of asset classes, including cryptocurrencies.

Increased rivalry in the IT sector as a result of new AI advancements and changing assumptions of U.S. monetary policy seem to be the main causes of the significant loss in the cryptocurrency market.

What you must understand

The next few days will probably be crucial. The cryptocurrency market is eagerly awaiting any updates on interest rates, which have a significant influence on speculative assets, as the first of eight Federal Open Market Committee (FOMC) meetings of the year draws near.

What you must understand

The next few days will probably be crucial. The cryptocurrency market is eagerly awaiting any updates on interest rates, which have a significant influence on speculative assets, as the first of eight Federal Open Market Committee (FOMC) meetings of the year draws near.

- Higher rates would generally discourage taking risks, which could cause recovery to be delayed. The bitcoin market has shown resilient following previous downturns, despite the volatility.

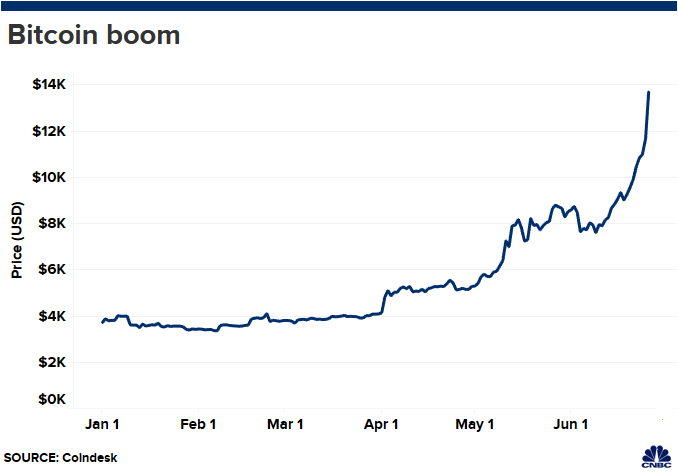

- For example, the 2014 Mt. Gox disaster caused the price of Bitcoin to plummet by 36%, and the 2022 Terra/Luna collapse caused it to plunge by 50%, from $40,000 to $20,000. Furthermore, while on different schedules, cryptocurrencies did eventually recover from bear markets in 2018 and 2022.

- It took Bitcoin over three years to hit fresh all-time highs following the 2018 meltdown. Due to institutional adoption and a revived interest in decentralized finance, Bitcoin recovered in 2023 after the market crash of 2022.

The market's long-term trend may still indicate growth, propelled by innovation, wider adoption, and stronger financial integration, even though the short-term recovery may be difficult.

Article Posted 4 Months ago. You can post your own articles and it will be published for free.

No Registration is required! But we review before publishing! Click here to get started

One Favour Please! Subscribe To Our YouTube Channel!

468k

Cook Amazing Nigerian Dishes, Follow Adorable Kitchen YouTube Channel!

1.1m

Like us on Facebook, Follow on Twitter

React and Comment

Click Here To Hide More Posts Like This

Watch and Download Free Mobile Movies, Read entertainment news and reports, Download music and Upload your own For FREE.

Submit Your Content to be published for you FREE! We thrive on user-submitted content!

But we moderate!