Navigating High Uncertainty: The Naira's FX Liquidity Challenges

Despite the bullish dollar index in the global financial market, the Naira began Friday's session at N1,580/$ per dollar in the parallel market, down from N1,590/$ on Thursday.

The naira is weak, according to recent socioeconomic fundamentals in Nigeria.

Because Nigeria depends heavily on fossil fuels for its foreign exchange revenues, the naira is a derivative of crude oil. The Nigerian currency is suffering due to worries about sluggish demand, rising trade tensions between the United States and significant trading partners, and hikes in OPEC+ production quotas.

Commercial banks have been accused by Nigerian Bureau de Change operators of failing to sell them foreign cash.

The naira is weak, according to recent socioeconomic fundamentals in Nigeria.

Because Nigeria depends heavily on fossil fuels for its foreign exchange revenues, the naira is a derivative of crude oil. The Nigerian currency is suffering due to worries about sluggish demand, rising trade tensions between the United States and significant trading partners, and hikes in OPEC+ production quotas.

Commercial banks have been accused by Nigerian Bureau de Change operators of failing to sell them foreign cash.

Did you know? You can comment on this post! Just scroll down

More insights

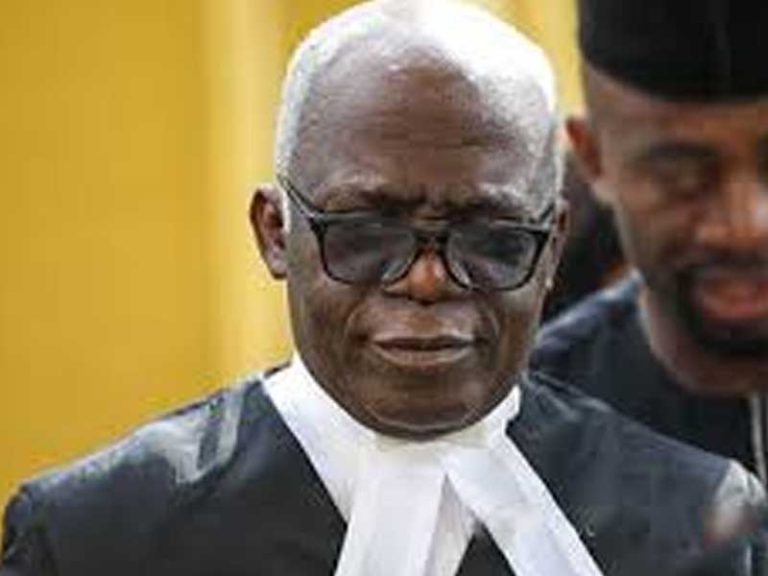

Aminu Gwadabe, president of the Association of Bureau de Change Operators of Nigeria (ABCON), expressed worry that BDCs are having trouble with a lack of foreign exchange.

Despite CBN efforts to improve rates, demand for Nigerian one-year treasury bills has been steadily declining, putting the country's reliance on FPI inflows in jeopardy.

Despite CBN efforts to improve rates, demand for Nigerian one-year treasury bills has been steadily declining, putting the country's reliance on FPI inflows in jeopardy.

- At this surprise auction, yields on one-year T-bills rose from 22.52 percent to 24.9 percent, marking the second straight increase as the market was still affected by liquidity shortages.

- Compared to N1.5 trillion in the first auction of 2024, the demand for one-year T-bills dropped precipitously to N861 billion on Wednesday, the lowest level this year.

- In the midst of a continuing political conflict between the state and the federal government on the allocation of federal funds to Rivers, militants have vowed to target the state's oil infrastructure.

- An explosion earlier this week destroyed the Trans-Niger Pipeline, one of the main routes for delivering crude that is pumped in the Niger Delta to the export terminal at Bonny.

The explosion sparked a massive fire at a section of the pipeline, necessitating an immediate rerouting of the oil flow.

Nigeria produced 1.7 million barrels of oil per day at its highest point in 2024. In the next two years, the Federal Government wants to drastically raise that by almost 1 million barrels per day.

But pipeline vandalism and oil theft make such optimism nearly impossible, giving the naira a gloomy outlook.

Nonetheless, the recent drop in Nigeria's inflation rate was aided by the naira's relative stability during the first quarter.

According to NBS data, the nation's inflation rate had its first decline in 2025, reducing from 24.48 percent in January to 23.18 percent in February. The drop was caused by a stable naira, lower energy prices, and the rebasing of Nigeria's inflation index.

Nonetheless, the recent drop in Nigeria's inflation rate was aided by the naira's relative stability during the first quarter.

According to NBS data, the nation's inflation rate had its first decline in 2025, reducing from 24.48 percent in January to 23.18 percent in February. The drop was caused by a stable naira, lower energy prices, and the rebasing of Nigeria's inflation index.

U.S. Dollar Strength Shows Recovery

The dollar appreciated as traders placed bets that there would not be any short-term interest rate cuts, but concerns about higher tariffs and slower growth tempered risk appetite.

- The dollar bounced back from its post-Fed losses as markets became more certain that the Federal Reserve would keep rates higher for longer this year, even though the central bank stuck to its 2025 rate-cut projections of 50 basis points. The dollar index and dollar index futures increased 20 basis points, continuing an overnight recovery in London’s trading session on Friday.

- Market action confirmed that the U.S. Dollar Index is still showing indications of recovery, but there is still little upward momentum. Although bearish pressure is lessening, the Moving Average Convergence Divergence (MACD) histogram is still in negative territory, while the Relative Strength Index (RSI) is progressively rising.

- The Federal Reserve’s most recent policy stance, which reaffirmed expectations for two rate cuts in 2025, has kept FX traders’ attention. The index is settled comfortably in the 103–104 range amid solid economic data in the world’s largest economy. Markets have priced in a lower likelihood of short-term rate declines as the U.S. Federal Reserve kept interest rates unchanged this week.

- Data on U.S. unemployment claims also demonstrated labor market resilience, which the Federal Reserve considered when deciding whether to lower interest rates. For the most part, currency traders ignored U.S. calls from President Donald Trump for the Fed to lower interest rates.

According to U.S. President Donald Trump, a rate cut by the Fed "would be great" on Thursday.

However, the central bank stated that it had no such objective, pointing to the trajectory of inflation, Trump's tariffs, and heightened economic uncertainty. The Fed also raised its inflation prediction for 2025 while downgrading its growth outlook.

Given the growing tensions between Gaza and Turkey and the lack of a clear path to a ceasefire in Ukraine, geopolitical uncertainty is still high. U.S. bond yields are declining as a result of investors seeking refuge in Treasuries owing to geopolitical and economic uncertainty.

The expectation that yields will drop once the Fed starts to lower rates is what fuels the robust demand for U.S. assets. Following the Fed's policy decision, European markets show a range of emotions, while American equities markets trade carefully.

However, the central bank stated that it had no such objective, pointing to the trajectory of inflation, Trump's tariffs, and heightened economic uncertainty. The Fed also raised its inflation prediction for 2025 while downgrading its growth outlook.

Given the growing tensions between Gaza and Turkey and the lack of a clear path to a ceasefire in Ukraine, geopolitical uncertainty is still high. U.S. bond yields are declining as a result of investors seeking refuge in Treasuries owing to geopolitical and economic uncertainty.

The expectation that yields will drop once the Fed starts to lower rates is what fuels the robust demand for U.S. assets. Following the Fed's policy decision, European markets show a range of emotions, while American equities markets trade carefully.

Article Posted 2 Months ago. You can post your own articles and it will be published for free.

No Registration is required! But we review before publishing! Click here to get started

One Favour Please! Subscribe To Our YouTube Channel!

468k

Cook Amazing Nigerian Dishes, Follow Adorable Kitchen YouTube Channel!

1.1m

Like us on Facebook, Follow on Twitter

React and Comment

Click Here To Hide More Posts Like This

Watch and Download Free Mobile Movies, Read entertainment news and reports, Download music and Upload your own For FREE.

Submit Your Content to be published for you FREE! We thrive on user-submitted content!

But we moderate!